how much does colorado tax paychecks

Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. How Much Does Colorado Tax Paychecks.

Colorado Payroll Tools Tax Rates And Resources Paycheckcity

How much does colorado tax paychecks Wednesday May 25 2022 Edit This tool has been available since 2006 and is visited by over 12000 unique visitors daily and has been.

. For 2022 the unemployment insurance tax range is from 075 to 1039. So the tax year 2022 will start from July 01 2021 to June 30 2022. The colorado salary calculator will show you how much income tax you will pay each paycheck.

How much does colorado tax paychecks Saturday July 16 2022 Edit. Revenue Online e-check or credit card with transaction fees or by Electronic Funds Transfer EFT in Revenue. The Centennial State has a flat income tax rate of 450 and one of the lowest statewide sales taxes in the country at just 290.

Instructions on how to use each method can be found in the Colorado Income Tax Withholding Worksheet for Employers DR 1098. Federal tax rates like income tax Social Security 62 each for both employer and. Entities that withhold from amounts paid.

Simply enter their federal and state W-4 information as. Fast easy accurate payroll and tax so you can. One of the new laws HB-1311 will eliminate certain state tax deductions for individuals and.

Colorado Salary Paycheck Calculator. And if youre in the construction. The Colorado Withholding Worksheet for Employers DR 1098 prescribes the method for calculating the required amount of withholding.

It changes on a yearly basis and is dependent on many things including wage and industry. Colorado Unemployment Insurance is complex. Whose tax payments may increase.

The state income tax in Colorado is assessed at a flat rate of 463 which means that everyone in Colorado pays that same rate regardless of their income level. The Centennial State has a flat income tax rate of 450 and one of the lowest statewide sales taxes in the. However because of numerous additional.

Employers are required to file returns and remit. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4. Calculating your Colorado state income tax is similar to the steps we listed on our Federal paycheck calculator.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Colorado. Online Payment in Revenue Online. Payment methods for withholding tax depend on how much total tax is withheld annually.

Colorado Wage Withholding Reported Annually. The calculator on this page is provided through the adp. Do you make more than 400000 per year.

New Tax Law Take Home Pay Calculator For 75 000 Salary

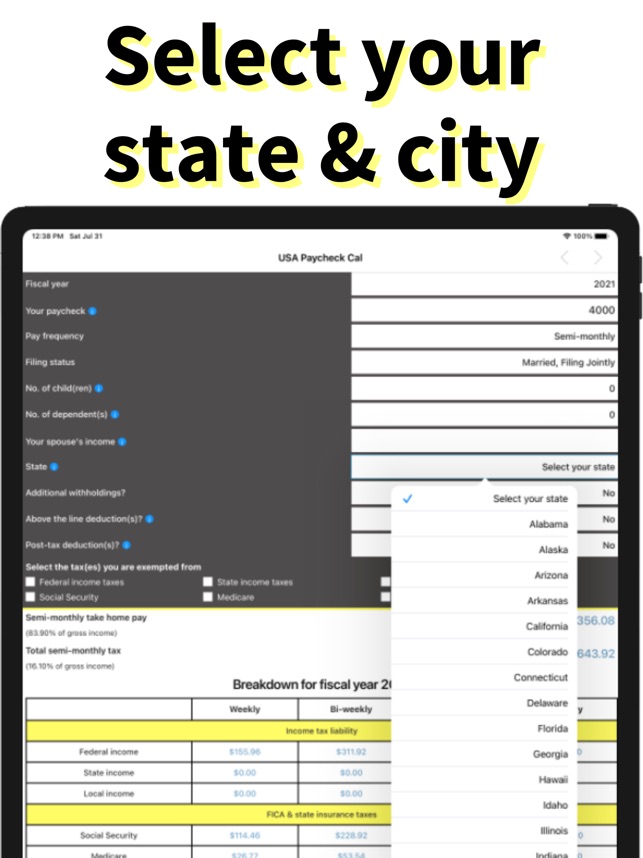

Usa Paycheck Calculator On The App Store

Lafayette Wl Lock In New Income Tax For Police Fire Hits Paychecks In 2020

Alaska State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Take Home Paycheck Calculator Hourly Salary After Taxes

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

New York Hourly Paycheck Calculator Gusto

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Colorado Paycheck Calculator Smartasset

Oral Medicine Resident Salary In Colorado Springs Co Comparably

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Usa Paycheck Calculator On The App Store

Payroll Tax Calculator For Employers Gusto

Hourly Paycheck Calculator Nevada State Bank

Here S How Much Money You Take Home From A 75 000 Salary

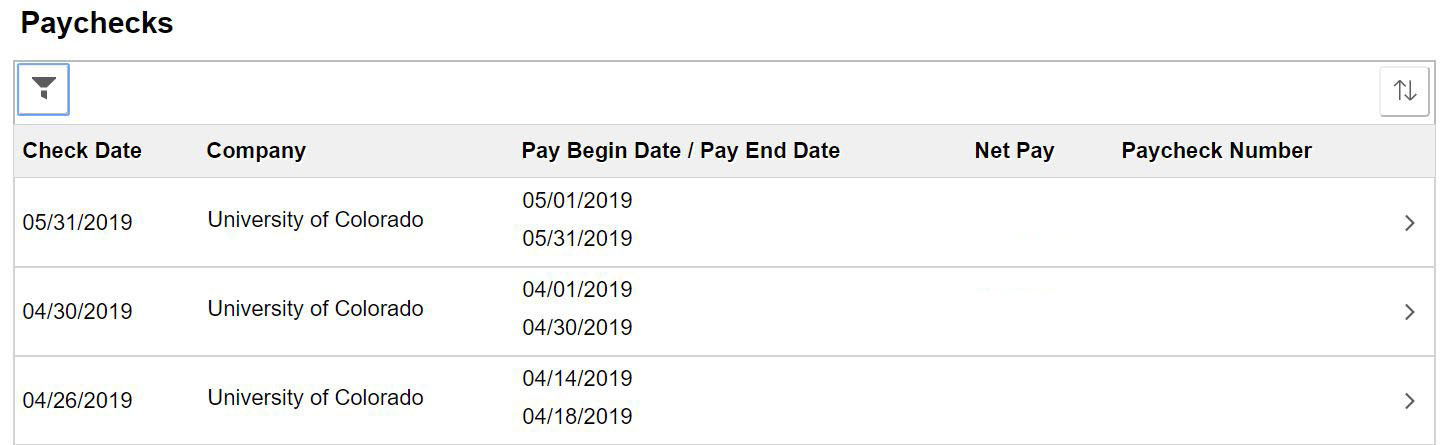

Imputed Income University Of Colorado

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Can You Opt Out Of Paying Social Security Taxes Mybanktracker